All Categories

Featured

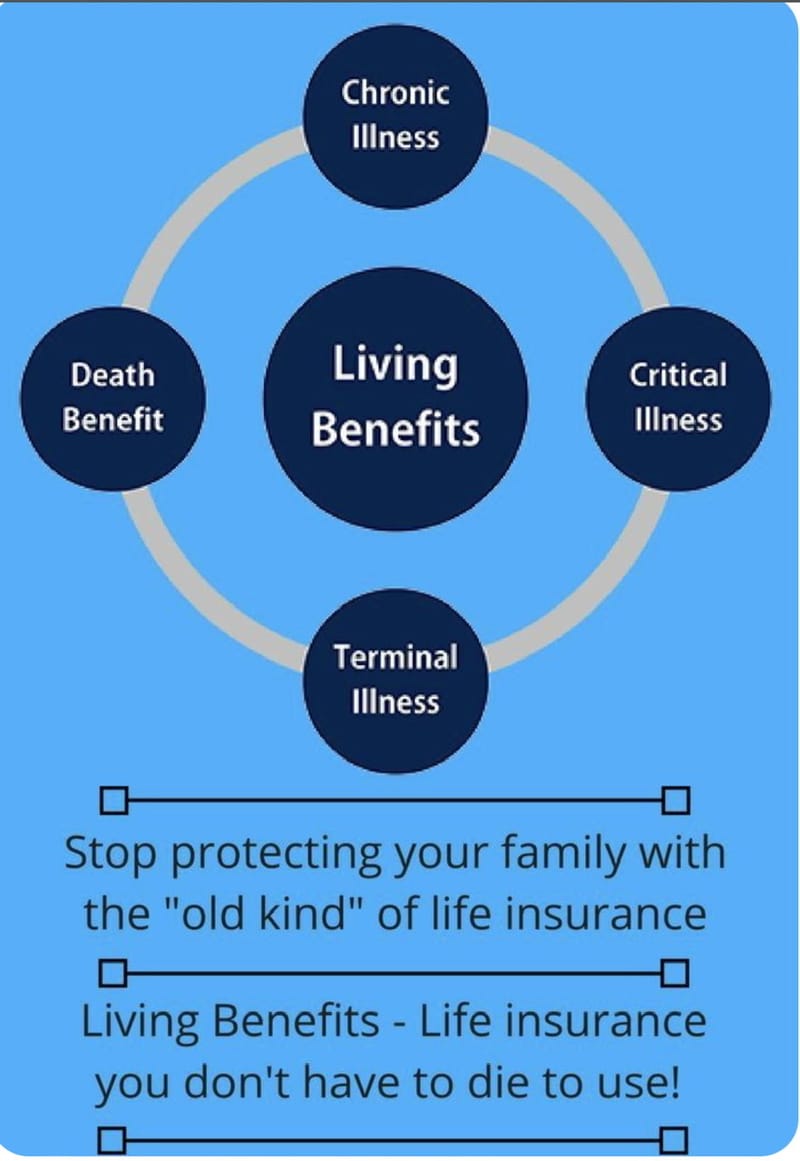

Cash worth is a living benefit that continues to be with the insurance provider when the insured dies. Any outstanding loans versus the cash worth will certainly minimize the plan's fatality advantage. Flexible premiums. The plan proprietor and the guaranteed are typically the very same individual, yet in some cases they may be different. As an example, a service might purchase essential individual insurance policy on an essential worker such as a CEO, or an insured could market their very own policy to a 3rd party for cash money in a life negotiation.

Latest Posts

Life Insurance Expenses

Published Apr 06, 25

8 min read

Final Expense Insurance Agencies

Published Apr 06, 25

7 min read

Best Final Expense Carriers

Published Apr 04, 25

7 min read